Sugar tax: too weak to be healthy?

This is according to a range of organisations speaking ahead of tomorrow’s (Friday 31st March) deadline for comment on the sugary drinks tax.

“The changes to the design of the tax have reduced it from an approximate 20 percent tax to now an approximate 10 percent tax,” says Wits University’s economic think-tank Priceless. “The much smaller increase in price is a less significant deterrent.”

The price increase on a 330ml can of Coca Cola will be about 42 cents instead of the R1 initially proposed, says Priceless.

“While the 10% taxation is certainly a step in the right direction, it may not be enough to have a positive impact on consumers’ health,” says Dr Craig Nossel, Head of Discovery’s Vitality Wellness.

“Research published earlier this year looked at the impact of food pricing on dietary intake. It was found that each 10% increase in price decreased consumption of unhealthy food and beverages by 6%. When sugary beverages were evaluated separately, consumption decreased to nearly 7%.”

Revert to 20 percent

Nossel “strongly encourages” government to revert to the original 20 percent proposal as this “will indicate a commitment to address the high correlation between obesity, non-communicable diseases and intake of sugary drinks.”

Treasury’s new proposal involves a tax of 2.1cents per gram of sugar, but it has decided thar the first 4g of sugar per 100ml will be exempted from the tax.

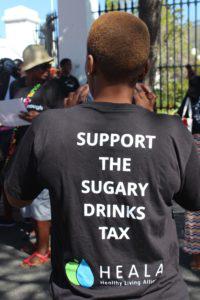

Tracey Malawana of the Healthy Living Alliance (Heala) said that there was “no health justification for the exemption on the first 4g per 100ml, and no other country with a successful sugary drink tax has done this”.

Nossel also proposed that Parliament scrap the 4g tax exemption in order to “encourage manufacturers to reformulate products to have a lower sugar content and thereby benefit consumers”.

Treasury has also proposed that concentrates (squashes and syrups) will be taxed at 50 percent of the proposed rate because consumers add water to these products.

But Heala wants the tax on concentrates to be increased as “this is the fastest growing segment of the sugary drink market”, with consumption almost doubling in the past seven years.

“To achieve its objective of improving health, the tax must encourage South Africans to consume beverages that are lower in sugar, instead of switching to cheap sugary concentrates,” says Malawana.

Use tax for health promotion

She also said Treasury needs to clarify whether fruit and vegetable juices and dairy-based drinks with added sweeteners (whether using a fruit juice, concentrate-based sweetener, or any other caloric sweetener) are to be taxed.

Heala also wants the tax revenue to be used for health promotion measures, such as “increasing the number of community healthcare workers, funding nurses in schools, implementing health and nutrition education campaigns and improving water and sanitation infrastructure”, says Malawana.

Heala also wants the tax revenue to be used for health promotion measures, such as “increasing the number of community healthcare workers, funding nurses in schools, implementing health and nutrition education campaigns and improving water and sanitation infrastructure”, says Malawana.

Priceless, Heala and Vitality all propose taxing 100 percent fruit juice as well.

“The health benefits of fruit juice can be misleading, considering the low fibre and very high sugar and energy content,” says Nossel. “There is also growing body of evidence that supports the link between drinking a lot of fruit juice and overweigh, obesity and type 2 diabetes. Combine this with the fact that consumers may start drinking more fruit juice if it is not taxed, and it could have the exact opposite effect on people’s health than this tax intends.”

The Beverage Association of South Africa failed to respond to requests for comment on the tax despite being given two days to do so.

The public can comment on the sugary drinks tax proposals by emailing comments Mmule Majola at mmule.majola@treasury.gov.za and Adele Collins at acollins@sars.gov.za by the end of tomorrow (31 March). – Health-e News Service.

Author

Republish this article

This work is licensed under a Creative Commons Attribution-NoDerivatives 4.0 International License.

Unless otherwise noted, you can republish our articles for free under a Creative Commons license. Here’s what you need to know:

You have to credit Health-e News. In the byline, we prefer “Author Name, Publication.” At the top of the text of your story, include a line that reads: “This story was originally published by Health-e News.” You must link the word “Health-e News” to the original URL of the story.

You must include all of the links from our story, including our newsletter sign up link.

If you use canonical metadata, please use the Health-e News URL. For more information about canonical metadata, click here.

You can’t edit our material, except to reflect relative changes in time, location and editorial style. (For example, “yesterday” can be changed to “last week”)

You have no rights to sell, license, syndicate, or otherwise represent yourself as the authorized owner of our material to any third parties. This means that you cannot actively publish or submit our work for syndication to third party platforms or apps like Apple News or Google News. Health-e News understands that publishers cannot fully control when certain third parties automatically summarise or crawl content from publishers’ own sites.

You can’t republish our material wholesale, or automatically; you need to select stories to be republished individually.

If you share republished stories on social media, we’d appreciate being tagged in your posts. You can find us on Twitter @HealthENews, Instagram @healthenews, and Facebook Health-e News Service.

You can grab HTML code for our stories easily. Click on the Creative Commons logo on our stories. You’ll find it with the other share buttons.

If you have any other questions, contact info@health-e.org.za.

Sugar tax: too weak to be healthy?

by kerrycullinan, Health-e News

March 30, 2017